In the Commonwealth of Virginia, cities and counties are separate governing entities and school districts do not have their own taxing authority. Greater Richmond is comprised of the City of Richmond and Chesterfield, Hanover and Henrico counties.

Both state and local governments are supportive of business. The tax burden is moderate and is shared between businesses and individuals. Virginia’s 6 percent corporate income tax rate has not changed since 1972.

State and local governments are required to operate with balanced budgets and are known for their fiscal responsibility. Virginia consistently receives a Triple A bond rating from the major rating agencies.

Incentives

Virginia and Greater Richmond have established many business incentives that benefit new and existing businesses, both in the short and long term. Incentives include financial assistance, infrastructure development grants, tax credits and exemptions, customized training and technical support programs.

Regional Support

GRP’s support services include research, information, publications and other services. In addition to real estate information, the Partnership maintains information on critical business factors, including labor, education and training, transportation, utilities, taxes, incentives, area industries and business climate. Presentations tailored to a company’s specific needs and comparisons with other metropolitan areas and states can be provided. These services are provided at no cost to prospective businesses.

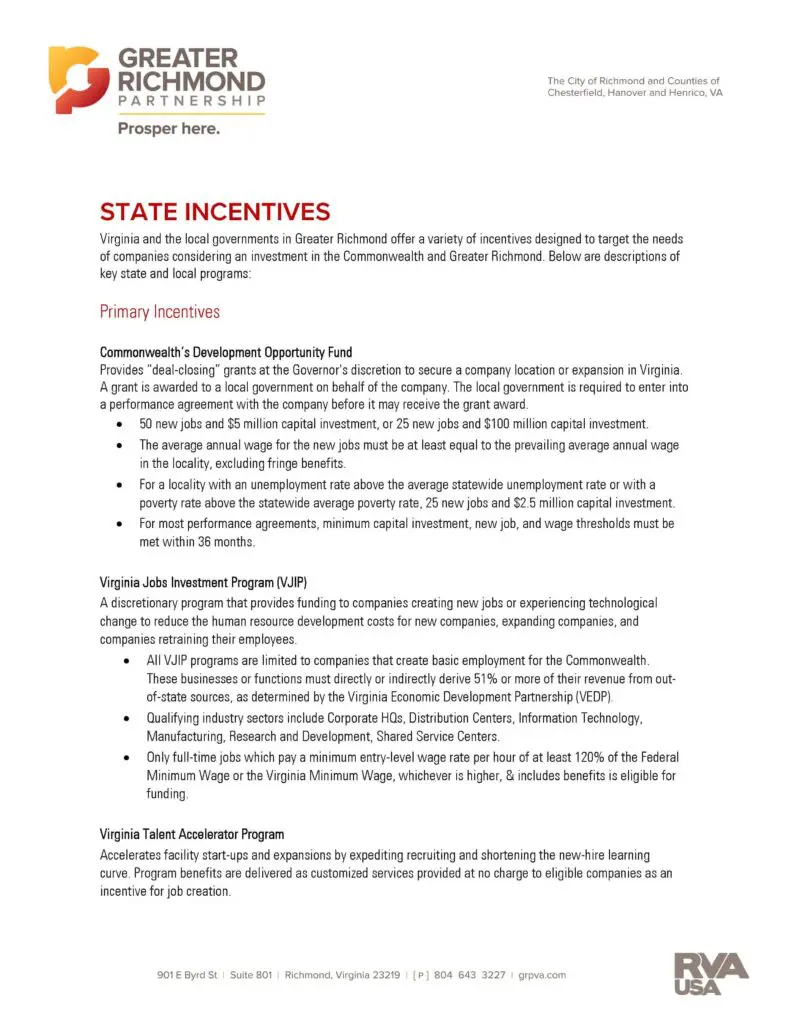

State Incentives

The Virginia Economic Development Partnership provides a variety of incentive and grant programs for competitive projects evaluating a location in the Commonwealth. Opportunities include discretionary incentives, financial assistance, infrastructure assistance, recruitment and training incentives and tax incentives.

Local incentives

Once a project has narrowed its real estate search, local economic development partners may offer an incentive package. The following pages link directly to local economic development websites and offer insight on the types of incentives and/or grants available in that municipality:

- City of Richmond incentives

- Chesterfield County incentives

- Hanover County incentives

- Henrico County incentives

Workforce Recruitment Services

The Greater Richmond Partnership has developed a variety of services to assist new corporate citizens relocating to the region and to facilitate the ramp-up process. Relocation services are available through GRP in cooperation with local businesses. The Partnership can provide a wide variety of community information including print publications and maps. GRP also can coordinate employment assistance through local staffing agencies and the Virginia Employment Commission.