Blog

Blog | 5 min read

August 27, 2025

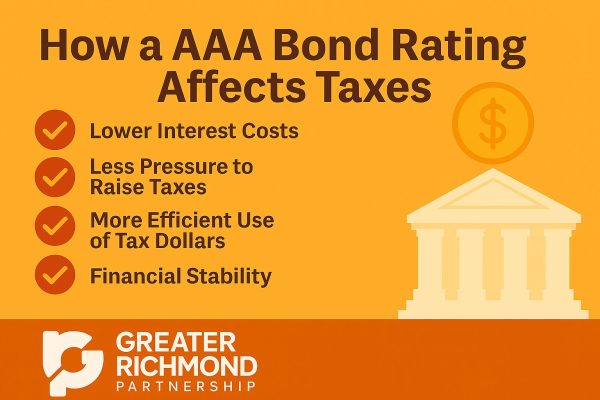

According to the top rating agencies, Greater Richmond now has two of the three only counties in the United States to receive quad AAA rating. A Triple-A (AAA) bond rating means the county is financially strong and can borrow money at very low interest rates. This saves taxpayer dollars, reduces pressure to raise taxes, and allows more funding for public services like schools, roads and emergency response.

Henrico is the newest municipality to receive such a rating after Chesterfield County, Va. and a county in Texas. This continues the trend for our local jurisdictions ranking in the top 1% for U.S. bond assurances. The recent addition of Kroll to the Federal Reserve’s existing three rating agencies means that a quad AAA rating is now the highest credit rating possible.

Only 47 counties nationwide are triple AAA rated, and 11 of them are in Virginia. This is the highest amount of triple AAA counties in any state, followed by Maryland with eight and North Carolina with five. The Richmond MSA has one of the highest concentrations of triple AAA credit ratings of Metro Statistical Areas (MSA) in the U.S., alongside Maryland’s Baltimore MSA and the Washington, D.C., MSA.

Only 47 counties nationwide are triple AAA rated, and 11 of them are in Virginia. This is the highest amount of triple AAA counties in any state, followed by Maryland with eight and North Carolina with five. The Richmond MSA has one of the highest concentrations of triple AAA credit ratings of Metro Statistical Areas (MSA) in the U.S., alongside Maryland’s Baltimore MSA and the Washington, D.C., MSA.

Municipalities rely on esteemed third-party entities to provide credit ratings, research and risk analyses to assist them in making timely decisions regarding debt strategies for bonds. It is important for a municipality to be aware of its current financial stability and outlook to remain in good financial standing while receiving and repaying its bonds.

Henrico

Henrico County most recently earned a quad AAA bond rating and stable outlook from Kroll’s citing the county’s “robust financial policies and procedures that have enabled continued growth in the unassigned fund balance and strong levels of liquidity, while allowing for taxpayer rebates; a relatively low fixed cost burden; and a diverse economic base with favorable socioeconomic characteristics.”

Henrico County has held AAA and AAA ratings for GO bonds from Moody’s and Standard & Poor’s since 1977 — becoming one of the first counties in the nation to receive the highest bond rating at that time — and from Fitch since 1998.

Henrico will be issuing $88 million in general obligation bonds in September 2025 to support a package of capital improvement projects. They include new buildings for education, parks and infrastructure improvements countrywide. Separately, Henrico EDA plans to issue $42.5 million in revenue bonds to support other capital projects.

Chesterfield

In 2019, Chesterfield was assigned AAA rating from each of the four credit ranking agencies — Kroll, Moody’s, Standard & Poor’s and Fitch — is considered quad AAA credit status.

The county has maintained triple AAA ratings in GO bonds since 1997, one from each rating agency. Moody’s said that Chesterfield’s 2018 AAA rating for the county and GO bonds “reflects the county’s favorably located, sizable, and diverse tax base, as well as its regional importance in the economy; strong financial operations guided by sound fiscal guidelines; and an elevated but manageable debt position.”

Hanover

Hanover County is among the 1% of counties nationwide to have received the triple AAA credit designation. Moody’s ranks Hanover County as AAA with a stable outlook as of 2024 and assigned AAA ratings to its 2024 General Obligation (GO) bonds. GO bonds fund government projects that will improve the local communities, and a municipality may use any revenue source to repay the bond.

Fitch rated Hanover County as AAA overall and for its GO bonds in 2024 with a stable outlook, and Standard & Poor’s also rated the county as AAA. Fitch said the assigned AAA rating reflects “the county’s notable financial flexibility, lack of legal limitations on taxing its growing property base, and low debt levels.”

City of Richmond

The City of Richmond bond ratings have also improved. In May 2024, Fitch rated the city AAA based on the City’s strong finances, economic profile and well managed operations. Moody’s has issued an AA1 rating and Standard & Poor’s has issued AA+ long ratings on the City of Richmond’s bonds. These agencies offer impartial evaluations of a bond issuer’s financial strength and their ability to repay a bond’s principal and interest. This allows the city to borrow money at the lowest interest rates possible and translates into significant savings of millions of dollars for their residents.

How bond rankings work

Besides newcomer Kroll, the other three top entities that issue bond ratings are Moody’s Investors Service, Standard & Poor’s and Fitch Ratings. Each has nine different ratings for bonds issued nationwide. At Moody’s, the top three highest are AAA, followed by AA and then A. Numerical markers may be added to ratings AA through CAA to further specify rankings, with 1 being highest. AAA is defined as “of the highest quality, subject to the lowest level of credit risk.” Standard & Poor’s and Fitch issue assessments with slightly different ranking labels: AAA is the highest ranking on both service’s scales. Should a municipality receive an AAA rating from each of the rating entities — an achievement for only the top performing municipalities — it is considered quad AAA.